jackson county personal property tax

Personal property taxes are levied against all tangible personal property used in a trade or business used for the production of income or held as an investment that should be or is subject to depreciation for federal income tax purposes including but not limited to mobile homes not on permanent foundations billboards and materials for use in production. Ad valorem property taxes business personal property taxes public service corporation taxes Oklahoma Tax Commission payments and.

Paying Your Taxes Online Jackson County Mo

From questions about your statement to where and how you can pay your taxes here are some resources on our website to help guide you.

. Paying a Property Tax Bill Pay a Jackson County Property Tax Bill Pay Multiple Tax Bills at One Time Link Multiple Property Accounts on myJacksonCounty Howwhen will I get my receipt. Pay your property taxes or schedule future payments. Jackson county personal property tax receipt. Any taxes paid after October 15th will be assessed as delinquent and penalties will be applied.

If there are errors on your electronic Tax Statements or you do not own property for which you are billed please contact your Jackson County Tax Collectors office at 1-870-523-7413. The primary responsibility of the Treasurer is to receive manage and invest all revenues received by Jackson County Government. Property tax information last updated. View an Example Taxcard.

Undetermined at this time. I recently moved to Jackson County from another state and have never paid personal property tax in Missouri. Skip the trip to the court house and pay your property taxes on the go. Welcome to the Jackson County Tax Collector ePayment Service Site.

Personal property tax is paid to Jackson County by December 31 of every year on every vehicle you owned on January 1. Property tax statements will be mailed by October 25th for the 2020-2021 tax year. Business Personal Property is any property other than real property which is composed of tangible assets held for use in a business. If youre ready to pay property taxes schedule a future payment or locate a receipt continue to myJacksonCounty.

Paying taxes online takes just a few minutes. Do not place cash in either drop box. Box 106 Ripley WV 25271 304 373-2280. Please contact PayIt Customer Support at.

If you have not received your statement by November 1st. If you were assessed and paid taxes in. The Tax Collectors office is used for paying all County taxes both delinquent and current. 6 hours ago If you have current paid property tax receipts or a tax waiver from your previous county for the last two years you will take these along with the other required information such as titlesapplication for title vehicle registrations or renewals to the Department of Revenue branch office.

January 15 2021 2100. The Personal Property Division consists of business personal property individual personal property and motor vehicles. This site was created to give taxpayers the opportunity to pay their taxes online. Its fast and secure.

Personal Property taxes are considered delinquent the day after they are due. Its that time of year again when property tax statements start showing up in mailboxes across Jackson County. 2 if paid in January. Alternatively if you already have your property linked to.

Search by any combination of these. Next Property Tax Sale will be. Both drop boxes will close at midnight. If you obtain a 2 year license plate with the State you are still responsible to pay personal property tax each year by December 31 or interest and penalty will be applied to your account.

4 if paid in November. If you have a dispute pay the taxes and pursue action to show why reimbursement should be made. Tax statements are mailed on or before November 1 of each year with payments receiving the following discount rates. Enter Taxpayer Name last first.

The time frame for paying taxes is from March 1 through October 15th. Taxpayers may enter in the parcel numbers they would like to pay or search by name andor address to retrieve parcel numbers. Inventory supplies movable furniture fixtures equipment leasehold improvements rental furnishings and other personal property used by business and industry. Taxes become delinquent April 1 of each year at which time a 15 penalty per month 18 per year is added to the bill.

Personal Property Tax - A Yearly Tax. Individuals or businesses owning or possessing personal property used or connected with a business or other income producing purpose are required to list annually with the Tax Assessors Office. Something Doesnt Look Right I Cant Find My Property I No Longer Own This Property. Keep track of properties and upcoming bills online.

What do I need to do. Visit myJacksonCounty Get the app Download an official app of Jackson County Missouri myJacksonCounty. Additions deletions or corrections to Personal Property are made with the Jackson County Assessors office and cannot be modified electronically. 3 if paid in December.

But once the opportunity to appeal with the Board of Review has passed and a bill has been issued the assessment and the bill are both valid and the tax is not refundable. Online Property Tax Payment Enter a search argument and select the search button. On December 31 a drop box for property tax payments will be located at the west door of the Jackson County Courthouse in Kansas City 415 E 12th Street and at the front door of the Historic Truman Courthouse in Independence 112 W Lexington. New residents moving to the County from another state will need vehicle registrations from the previous year through January 1 of the current year andor they can provide any combination of these documents showing an out-of-state address for the past year through.

Jackson County Sheriffs Tax Office PO. 410 - - S - 2ND STREET - 67000. Taxable Business Personal Property includes but is not limited to. Pay a Jackson County Property Tax Bill Caleb H.

1 if paid in February. Jackson County Tax Search. Enter Taxpayer Account Number. Download an official app of Jackson County Missouri myJacksonCounty.

Skip the trip to the courthouse and pay your property taxes on the go. November 11 2021 You may begin by choosing a search method below. All personal property and real estate taxes are to be paid at the Collectors office. Parcel numbers can be found on the taxpayers Property Tax Statement.

Once you have found and linked your property you can begin completing the payment from the conversation by clicking Pay Bills.

Mary Carol Murdock Jackson County Tax Collector

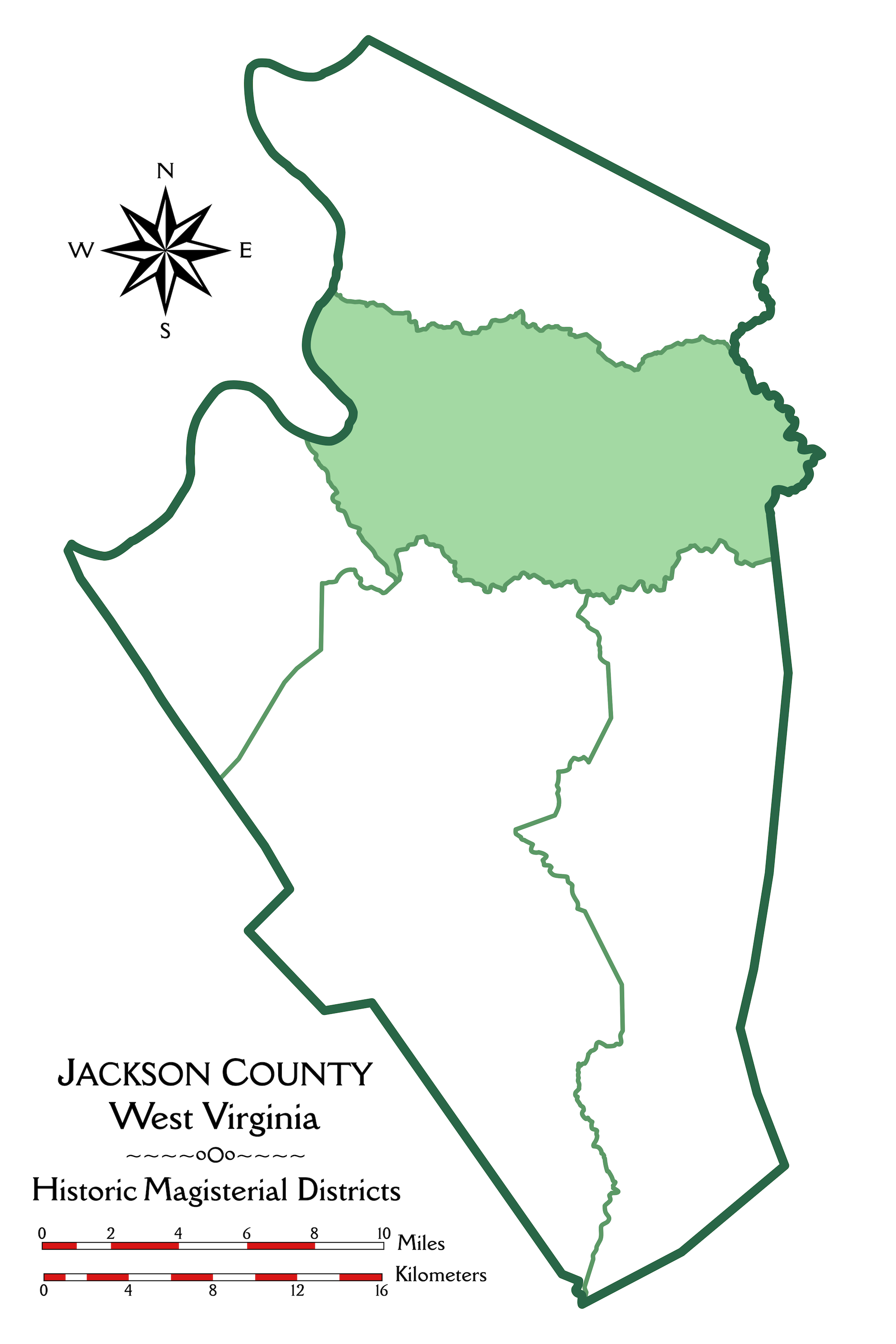

Ravenswood District Jackson County West Virginia Wikipedia

Tax Collector Jackson County Ms

Property Data Online Jackson County Oregon

Posting Komentar untuk "jackson county personal property tax"